More on @LdnIncMag cover story on amazing medical tech innovations #LdnOnt

/Some medical breakthroughs I understand. Most I do not.

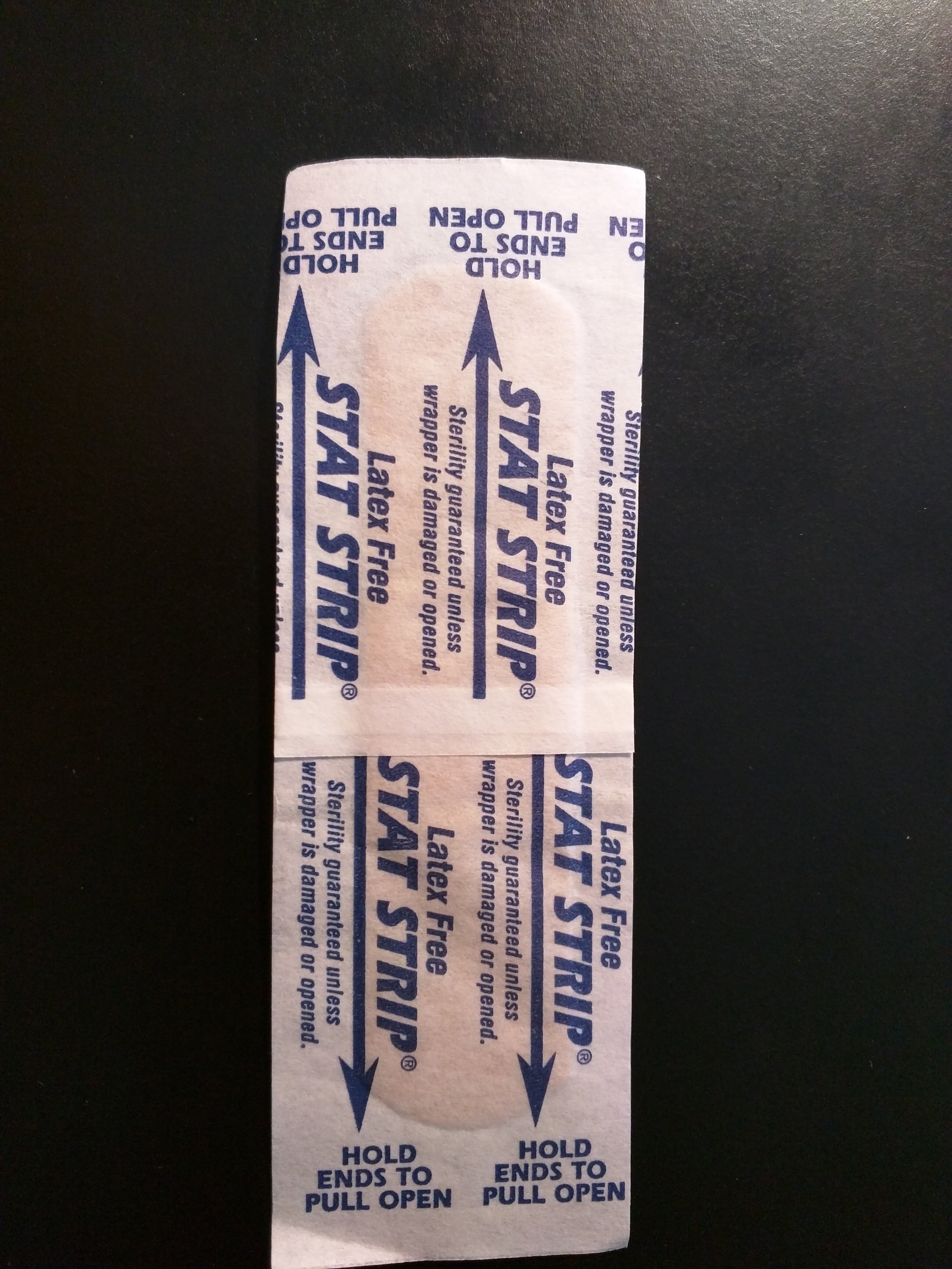

Stat Strip: All business

Here’s one I get: The handy Stat Strip, a bandage marketed to clinics and hospitals. Instead of tearing off the paper of a typical bandage by pulling on the proper end or finding the little string running down one side, the doctor or nurse simply pulls on both ends simultaneously, revealing a bandage free of all paper, the sticky part ready to go and not stuck to a finger or crimped with the remaining wrapper.

The Stat Strip is all business and gets the job done, which is what you want in a clinic. But it’s not nearly as entertaining as novelty bandages like Elmo or My Little Kitty. And it can’t even compete with the best bandage of all, Bacon Strips, which, as you can see here, looks like you have a piece of bacon covering your boo-boo. Genius.

Bacon strip: awesome

These are medical inventions I can understand and incorporate into my day.

Although I use various painkillers and allergy medicines from time to time, I have no idea how they work or why a loading dose of ibuprofen is a good idea but a loading dose of Claritin is a waste of time. I’m grateful they work, but I don’t understand them.

You can multiple that feeling 100 times to understand how I felt writing this month’s cover story for London Inc. magazine. After a warm and encouraging reception to the magazine’s inaugural issue in May, the June cover is about a program to support local medical entrepreneurs – researchers in many cases who have ideas but need helping developing them and getting their product to market.

The BURST program is being shepherded by TechAlliance of Southwestern Ontario, but is being supported by a dozen or more local organizations, many dedicated to medical research and development.

If you pay only casual attention to what’s going on in the London medical research world, you have some idea there are a bunch of groups doing a lot of interesting things. What you don’t know until you start interviewing some of the people running those organizations so you can write 2,000 words about the BURST program, is just how big their dreams are. There are people walking around in this city who have concrete plans to transform London into a worldwide medical innovation hub, something comparable to the way the Mayo Clinic transformed a chunk of rural Minnesota beginning 150 years ago.

There are also all kinds of smart people with a host of cool ideas to solve specific medical challenges. And those are the people BURST is designed to help, giving 30 organizations $70,000 each in cash and assistance to invigorate their ideas and help create usable, marketable products.

The first 10 organizations were chosen in March and are using the funds right now. The next 10 will be chosen in July; the final 10 in November. Not every idea will flower into something amazing. But a few almost certainly will.

And that is the whole point of BURST – identifying the best ideas and pushing them forward so the world will benefit from what people here in London are working on all around us.